are union dues tax deductible in 2020

To enter union dues in TaxAct. The deduction would last through 2025.

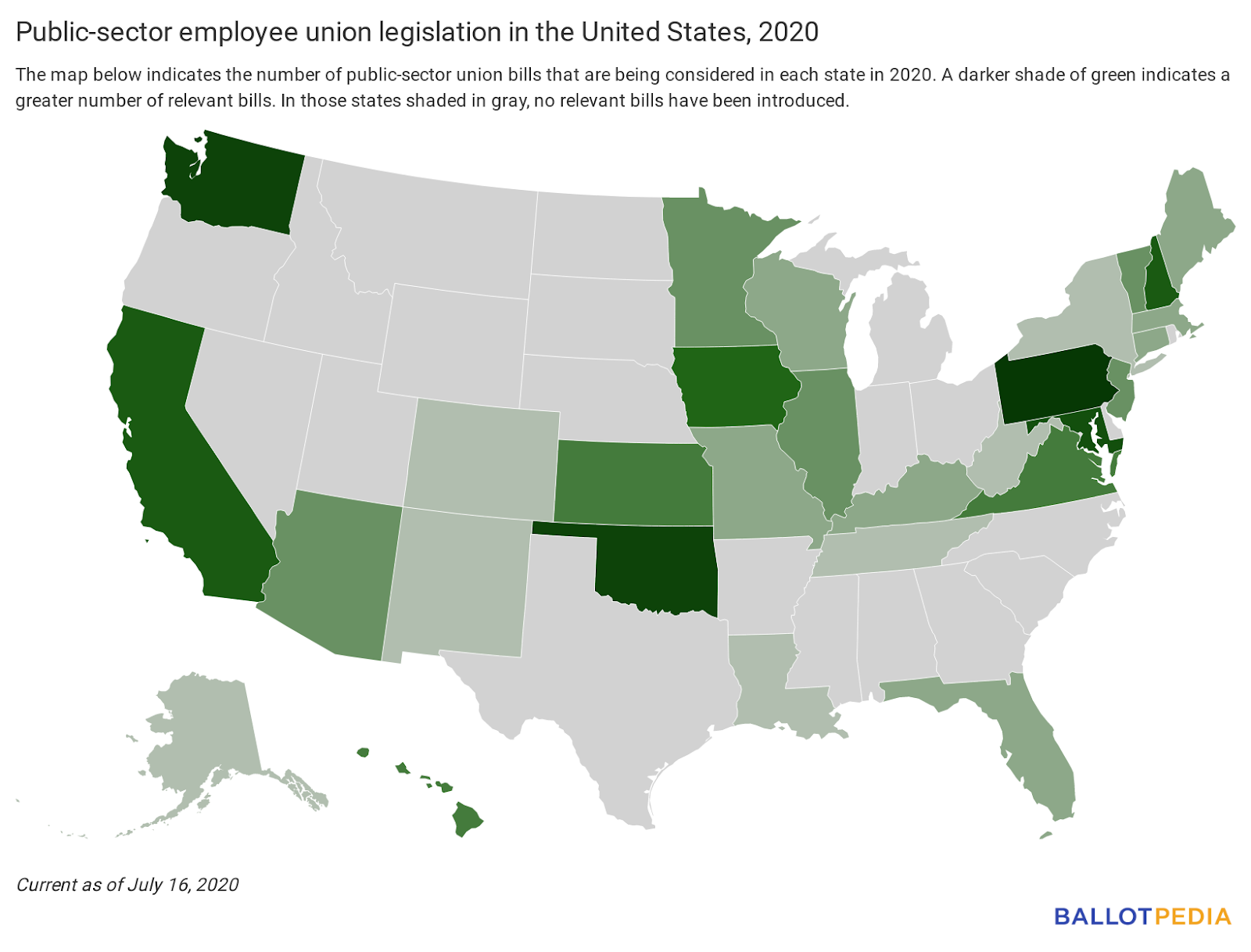

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News

You cant deduct voluntary unemployment benefit fund contributions you make to a union fund or a private fund.

. There are however a few. However most employees can no longer deduct union dues on their federal tax return in tax years 2018 through 2025 as a result of the Tax Cuts and Jobs Act TCJA that Congress signed into law on December 22 2017. A 2020 Center for American Progress Action Fund brief stated This type of above-the-line deduction would allow union members to deduct the costs of earning their income and result in the tax code more accurately measuring individuals ability to pay Opposition to union dues deductions.

The short answer is that dues may not be subtracted from taxable income in the tax years 2018 through 2025. Can I Deduct Union Dues Now. Annual dues for membership in a trade union or an association of public servants.

This is in response to an email we received from Craig Mutter on November 23 2020 and our discussion of January 14 2021 DAngeloMutter asking whether legislative changes made in Albertas Bill 32. This publication explains that you can no longer claim any miscellaneous itemized deductions unless you fall into one of the qualified categories of employment claiming a deduction relating to unreimbursed employee expenses. Tax reform eliminated the deduction for union dues for tax years 2018-2025.

SOLVEDby TurboTax8006Updated December 22 2021. However you can deduct contributions as taxes if state law requires you to make them to a state unemployment fund that covers you for the loss of wages from unemployment caused by business conditions. Professional board dues required under provincial or territorial law.

This prohibition was written into the tax reform legislation passed by the US. Prior to that year a union member could write off yearly dues as an unreimbursed employee business expense. Claim the total of the following amounts that you paid or that were paid for you and reported as income in the year related to your employement.

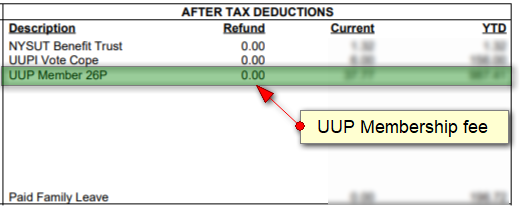

31 2021 the City of New York and other employers deducted union dues for the UFT from those UFT members who were so designated. However if the taxpayer is self-employed and pays union dues those dues are deductible as a business expense. Restoring Balance in Albertas Workplaces Act 2020 Bill 32.

Tax reform changed the rules of union due deductions. Union Dues or Professional Membership Dues You Cannot Claim. From within your TaxAct return Online or Desktop click on the Federal tab.

If you and your spouse are filing jointly and. A reminder for tax season. You cannot claim a tax deduction for initiation fees licences special assessments or charges not related to the operating cost of your company.

An employee business expense is generally defined as an expense paid by the employee for the purpose of carrying on a job with their employer or a business. The bill was announced April 15 by Democratic Senators Bob Casey of Pennsylvania Chuck Schumer of New York Patty. Claiming union dues twice can result in a notice of reassessment and a possible penalty tax and interest owing.

If you are an employee you can claim your union dues as a job-related expense if you itemize deductions. That is the deductibility has been suspended for tax years 2018 through 2025 inclusive. To enter your union dues for work performed as an employee W-2.

These are entered as unreimbursed employee expenses on Line 21 of Schedule A Form 1040 Itemized Deductions. We have printed a chart you can use to compute the amount deducted on your behalf and remitted to the UFT. During the year ending Dec.

Job-related expenses arent fully deductible as they are subject to the 2 rule. Union dues may be tax deductible subject to certain limitations. Furthermore you cannot claim a tax deduction.

Line 21200 was line 212 before tax year 2019. On smaller devices click the menu icon in the upper left-hand corner. I just did a return with Housing Allowance listed there.

Miscellaneous itemized deductions are those deductions that would have. Educator expense tax deduction renewed for 2020 tax returns. Brigitte Richer 2020-087195.

Deduction of union dues. The Tax Fairness for Workers Act would also restore the deduction for other unreimbursed employee expenses including travel and the cost of tools and uniforms that were killed in the 2017 package of tax breaks for the rich. If you are self-employed you can enter your union dues as a Schedule C business expense.

If youre self-employed you can deduct union dues as a business expense. The amount of dues collected from employees represented by unions is subject to federal and state laws and court rulings. In other words union dues would get the same treatment now reserved for things like insurance premiums and retirement contributions.

The NLRA allows unions and employers to enter into union-security agreements which require the payment of dues or dues equivalents as a condition of employment. Thanks to union victories the educator expense tax deduction has been renewed for 2020 returns - and theres a state deduction for your union dues too. Taxpayer is clergy Now Im wondering just hypothetically whether union dues on a clergy return could be used as a deduction for self-employment tax.

That would be fun to explain to a programmer. For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions. Learn about the Claim of Right deduction.

Federal law allows unions and employers to enter. 1 were not in fact entitled to the income and 2 have repaid the. Eligible educators can deduct up to 250 of qualified expenses you paid in 2020.

Taxpayers who have paid Massachusetts personal income taxes in a prior year on income attributed to them under a claim of right may deduct such amounts of that income from their gross income if it is later determined that they. You can deduct dues and initiation fees you pay for union membership. And yes the clergy do have unions in Great Britain and Canada.

Under current federal law employee business expenses are generally not deductible.

A Tax Break For Union Dues Wsj

Give Me A Tax Break Union Dues Changes And More On The Horizon Barnes Thornburg

A Tax Break For Union Dues Wsj

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News

Business Manager S Update On Pay Increase Allocations Local 393

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Sag P H Plans Unreasonable Fees And Expenses Appear To Have Violated Federal Law Dol Probe Finds Pensions How To Plan Labour Department

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News

Yes Virginia Unions Have To File Taxes Too American Postal Workers Union

Michigan Civil Service Commission Approves Union Dues Deduction Rule Change Ballotpedia News

Deducting Union Dues Drake17 And Prior

Union Dues Deductible On State Taxes Not On Federal Taxes Hawaii State Teachers Association

Deducting Union Dues On Nys Taxes Uup Buffalo Center

A Tax Break For Union Dues Wsj

Purchase Your Tickets Today For The Chance To Win One Of The 5 Prizes Listed Below Tickets Cost You Can Buy 5 For Drawing Held Wedn Union County Raffle Waxhaw